Earthquakes can be very dangerous for homeowners, causing damage to their property and belongings. Earthquake insurance is a key way to protect your home and things from these risks. It helps homeowners by offering financial support if an earthquake happens.

This insurance gives homeowners peace of mind and helps protect their investments. It’s a smart move to make sure your home and things are safe.

Key Takeaways

- Earthquake insurance covers damage to your home, personal property, and living expenses if you need to relocate during repairs.

- It offers financial protection against the costly repairs often associated with earthquake-related destruction.

- Earthquake insurance can be a requirement for homeowners in high-risk regions, providing compliance with mortgage lender guidelines.

- The coverage provides a safety net, allowing homeowners to recover and rebuild after a devastating earthquake.

- Investing in earthquake insurance can give you the confidence to protect your most valuable asset – your home.

Understanding Earthquake Insurance

Earthquake insurance helps protect against the financial damage from earthquakes. It’s different from regular homeowners insurance or renters insurance, which don’t cover earthquake damage. This policy is made to help when the ground shakes.

Definition and Purpose

Earthquake insurance aims to cover repair or rebuilding costs and replace personal items after an earthquake. It also helps with extra living expenses if you need to move out during repairs.

This insurance is key in areas at risk for earthquakes. It ensures your financial safety and a secure future against nature’s unpredictable forces.

“Earthquake insurance can be a lifesaver, providing the financial resources to rebuild your home and replace your belongings after a devastating quake. It’s a small price to pay for the peace of mind it offers.”

Earthquake insurance might seem like extra cost, but it’s crucial during an earthquake. Knowing what it does helps homeowners and renters decide how much protection they need for their financial future.

Earthquake Insurance Coverage

Earthquake insurance covers three main areas: your home, your belongings, and extra living costs. Knowing what’s covered helps homeowners prepare for an earthquake.

Covered Losses

Your home’s structure and attached buildings like garages can be fixed or rebuilt with dwelling coverage. Personal property coverage helps replace items inside your home that get damaged or destroyed. This includes things like furniture, electronics, and clothes.

Earthquake insurance also covers extra living expenses. If your home is damaged and you can’t live there, it pays for temporary housing and other higher living costs.

| Coverage Type | What It Covers |

|---|---|

| Dwelling Coverage | Repair or rebuild your home and attached structures |

| Personal Property Coverage | Replace damaged or destroyed items inside your home |

| Additional Living Expenses | Temporary housing and increased living costs if you can’t stay in your home |

Knowing what your earthquake insurance covers helps homeowners protect their property and way of life after an earthquake.

Geographical Risks and Earthquake Zones

Some parts of the United States are more at risk for big earthquakes than others. The USGS says California, Washington, Utah, Tennessee, Oregon, South Carolina, Nevada, Arkansas, Missouri, and Illinois are at the highest risk. These areas could face strong shaking.

But remember, earthquakes can happen anywhere in the country. So, every homeowner should check their area’s risk level. The USGS offers seismic hazard maps to show where the biggest risks are.

These maps look at fault lines, past earthquakes, and soil types. They help spot areas most likely to have big earthquakes. Knowing this helps homeowners decide if they need earthquake insurance or other safety steps.

“The states with the strongest shaking potential include California, Washington, Utah, Tennessee, Oregon, South Carolina, Nevada, Arkansas, Missouri, and Illinois.”

While the West Coast and some central states are at higher risk, all homeowners should know their area’s risks. Understanding where earthquakes are more likely to happen helps with insurance and getting ready for disasters.

Earthquake Insurance

Earthquake insurance is not a must-have, but it’s a smart choice for those living in areas prone to earthquakes. Most homeowners and renters insurance don’t cover earthquake damage, except for fire damage from an earthquake. To protect against earthquake damage, you need a special earthquake insurance policy.

These earthquake insurance policies are available from private companies or public programs like the California Earthquake Authority. They offer coverage for your home, belongings, and extra living costs if an earthquake hits.

When looking at earthquake insurance requirements and homeowners insurance exclusions, consider these factors:

- The level of seismic activity in your area

- Your home’s age and build

- The value of your belongings

- Your ability to pay for repairs or temporary housing

By looking at your earthquake coverage options, you can find the right protection for your needs and budget.

| Coverage Type | Typical Inclusions |

|---|---|

| Dwelling Coverage | Repairs or rebuilding of the home’s structure |

| Personal Property Coverage | Replacement of damaged or destroyed personal belongings |

| Additional Living Expenses | Costs of temporary housing and other living expenses during repairs |

“Earthquake insurance is a crucial safeguard for homeowners in seismically active regions. The peace of mind it provides is invaluable in the event of a devastating quake.”

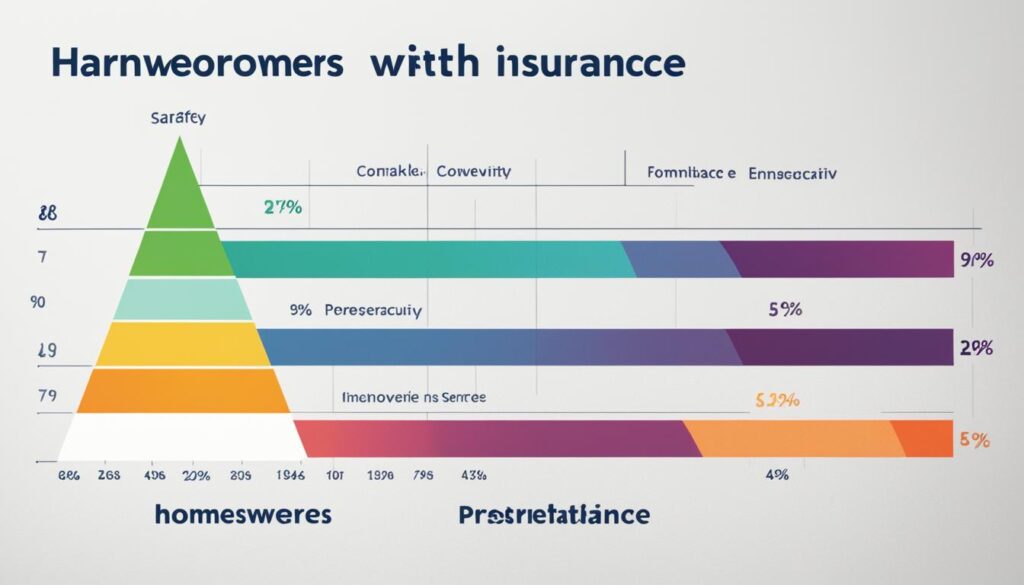

Percentage of Homeowners with Earthquake Insurance

Many parts of the United States face a high risk of earthquakes, yet few homeowners buy earthquake insurance. The Insurance Information Institute found that 28% of homeowners in the West, 25% in the South, 21% in the Northeast, and 16% in the Midwest have earthquake coverage. This shows we need to spread the word more about why this insurance is important.

Why do so few homeowners get earthquake insurance? It could be because they think it costs too much, don’t know about the risk, or believe their regular home insurance covers earthquakes. But, standard home insurance usually doesn’t cover earthquakes. That’s why earthquake insurance is key for those living in areas at risk.

| Region | Earthquake Insurance Adoption Rate |

|---|---|

| West | 28% |

| South | 25% |

| Northeast | 21% |

| Midwest | 16% |

There’s a big difference in how many homeowners in different areas have earthquake insurance. We need to reach out and teach people why this insurance is vital. By making more people aware of the risks and benefits, we can help them protect their homes and money from earthquakes.

Determining Adequate Coverage

When getting an earthquake insurance policy, it’s key to make sure you have enough coverage. Your dwelling coverage should match what you have on your homeowners insurance. This ensures you can fix or rebuild your home after a disaster. Also, personal property coverage should be enough to replace your valuables. And additional living expenses coverage can help with costs if you need to live somewhere else temporarily.

When figuring out how much coverage you need, think about your home’s age, how it was built, and how much it would cost to replace it. Also, make a list of your personal property. These things will help you pick the right earthquake insurance policy limits to protect your home and stuff.

- Dwelling coverage limit should align with homeowners insurance policy

- Personal property coverage should replace your valuables

- Additional living expenses coverage for temporary housing and costs

- Consider home’s age, construction, replacement cost, and personal property inventory

“Determining the right earthquake insurance coverage is essential to protect your home and assets in the event of a natural disaster.”

By looking at your coverage needs and picking the right earthquake insurance policy limits, you can rest easy. You’ll know your home and stuff are safe, even if something unexpected happens.

Earthquake Insurance Costs

The cost of earthquake insurance can change a lot based on several important factors. Premiums are usually higher in places more likely to have earthquakes. This includes older homes and those with more stories. The policy deductibles you pick also affect the earthquake insurance premiums. Choosing higher deductibles can make your yearly costs go down.

Earthquake insurance premiums can be between $800 and $5,000 a year. Deductibles are usually 10% to 20% of the coverage limit. In California, homeowners pay about $739 a year on average.

Factors Affecting Earthquake Insurance Costs

Several things can change how much you pay for earthquake insurance premiums and policy deductibles:

- Location: Homes in areas more likely to have earthquakes pay more.

- Age and construction of the home: Older homes and those with more stories cost more to insure.

- Deductible amount: Choosing a higher deductible means lower yearly costs.

- Coverage limits: More coverage means higher premiums.

- Earthquake mitigation measures: Homes with safety features might get discounts.

| Factor | Impact on Earthquake Insurance Costs |

|---|---|

| Location | Homes in high-risk earthquake zones have higher premiums. |

| Age and Construction | Older homes and those with multiple stories typically cost more to insure. |

| Deductible Amount | Higher deductibles lead to lower annual premiums. |

| Coverage Limits | Higher coverage limits result in higher premiums. |

| Earthquake Mitigation | Homes with retrofitting or other protective measures may qualify for discounts. |

“Earthquake insurance can be a big expense, but it’s crucial for homeowners in high-risk areas. Knowing what affects the cost helps you choose the right coverage for your needs.”

California Earthquake Authority (CEA)

The California Earthquake Authority (CEA) is the biggest provider of state-backed earthquake insurance in the U.S. It started in 1996. The CEA sells earthquake policies to homeowners, condo owners, and renters through insurance companies. To buy a CEA policy, you must have a residential earthquake coverage policy from your current insurance provider.

The CEA has different coverage options. These include coverage for your home, personal items, and extra living expenses. Deductibles are from 5% to 25% of the coverage amount. This lets homeowners tailor their earthquake insurance to fit their needs and budget.

| Coverage Type | Deductible Range |

|---|---|

| Dwelling | 5% to 25% of coverage limit |

| Personal Property | 5% to 25% of coverage limit |

| Additional Living Expenses | 5% to 25% of coverage limit |

The California Earthquake Authority is a non-profit, public group. It offers a dependable and affordable way for Californians to get residential earthquake coverage. By working with insurance companies, the CEA makes sure Californians can get the earthquake insurance they need to protect their homes and property.

“The CEA is a critical resource for Californians who want to safeguard their homes and families against the devastating effects of earthquakes.”

Exclusions and Limitations

Earthquake insurance has exclusions and limitations that homeowners need to know. These policies don’t cover everything. It’s important to understand what’s not protected to avoid surprises during a disaster.

Damage to things outside your home like landscaping, swimming pools, and fences is often not covered. Also, water damage from floods or sewer backups isn’t covered. Fire damage after an earthquake is usually covered by regular homeowners insurance, not earthquake insurance.

Personal property coverage in earthquake insurance has limits too. There are caps on how much you can get for damaged or destroyed items. Rebuilding your home to current codes might not be fully covered, leaving you with extra costs.

Homeowners should look closely at their earthquake insurance policy details. Knowing about earthquake insurance policy exclusions, covered vs. uncovered losses, and policy terms helps them make smart choices. This way, they can be better prepared for disasters.

| Exclusions | Limitations |

|---|---|

|

|

“Carefully reviewing the terms of any earthquake insurance policy is crucial to understanding what is and is not covered.”

Earthquake Retrofitting and Discounts

Homeowners can make their homes stronger against earthquakes by doing earthquake retrofitting. This means making changes to the home’s structure to better handle earthquakes. For example, bolting the foundation to the frame or bracing walls. Insurance companies give big insurance premium discounts of 10% to 25% for homes that are retrofitted.

Some homeowners might get grants or other help to pay for seismic upgrades. Retrofitting is a smart move to lower earthquake risk and insurance costs.

| Retrofit Measure | Potential Insurance Discount |

|---|---|

| Bolting foundation to frame | 10-15% |

| Bracing cripple walls | 15-20% |

| Reinforcing masonry chimneys | 5-10% |

By using earthquake retrofitting and insurance discounts, homeowners can greatly lower their financial risk. This also adds more protection for their property during big earthquakes.

Also Read: What Is Insurance Compliance And Why Is It Important?

“Earthquake retrofitting is one of the most effective ways for homeowners to safeguard their property and potentially save on insurance costs.”

Conclusion

Earthquake insurance is key for homeowners and renters in areas at risk for quakes. It offers financial protection against the damage a big quake can cause. Even though earthquake insurance can be expensive, it’s worth it to avoid the risks of not having it, especially in high-risk areas.

By looking into the different coverage options and seeing what they need, homeowners can make sure they’re ready for a disaster. This way, they can protect their most valuable assets when a quake hits.

Buying earthquake insurance benefits is a key part of getting ready for disasters. It helps people and families keep their home investments safe from earthquakes. With the right insurance, homeowners can bounce back financially after a quake.

Earthquake insurance is a must-have for those in quake-prone areas. It helps people recover and rebuild after a big quake. By knowing what coverage they need and making their homes stronger, homeowners can keep their investments safe. This helps their communities stay strong and resilient.

FAQs

Q: What is earthquake insurance?

A: Earthquake insurance is a specialized insurance policy that provides coverage for damages specifically caused by earthquakes.

Q: Do I need earthquake insurance if I already have home insurance?

A: While home insurance may cover some perils, it typically does not cover earthquakes. If you live in a region prone to earthquakes, it is advisable to get earthquake insurance.

Q: What does earthquake insurance cover?

A: Earthquake insurance covers damages to your property and belongings caused by an earthquake, such as structural damage and personal property loss.

Q: How much does earthquake insurance cost?

A: The cost of earthquake insurance can vary depending on factors such as your location, the value of your home, and the level of coverage you choose. It is best to consult with an insurer or insurance agent for specific pricing.

Q: What is an earthquake insurance deductible?

A: An earthquake insurance deductible is the amount you must pay out of pocket before your insurance coverage kicks in to cover damages caused by an earthquake.

Q: Does earthquake insurance cover all earthquake-related damages?

A: No, earthquake insurance typically does not cover all types of earthquake-related damages. It is important to review your policy to understand what is covered and what is not.

Q: Is earthquake insurance worth it if I live in California?

A: California is known for seismic activity, so earthquake insurance can be worth it if you live in the state. It can provide financial protection in case of a big earthquake.

Q: What is dwelling coverage limit in earthquake insurance?

A: Dwelling coverage limit in earthquake insurance is the maximum amount that the policy will pay out for damages to the structure of your home caused by an earthquake.

Source Links

- https://www.forbes.com/advisor/homeowners-insurance/earthquake-insurance/

- https://www.insurance.ca.gov/01-consumers/105-type/95-guides/03-res/eq-ins.cfm

- https://www.rocketmortgage.com/learn/earthquake-insurance