Student loan forgiveness means your federal student loan debt can be wiped out. This is a big help for those who borrowed a lot to go to college. You might qualify if you work in public service, education, or the military, or if you’re on an income-driven repayment plan.

But, only federal direct loans can get forgiveness. Private loans don’t count. You need to apply and keep paying until you meet the forgiveness program’s rules.

Key Takeaways on Loan Forgiveness

- Student loan forgiveness eliminates all or part of a borrower’s federal student loan debt.

- Eligibility is often limited to certain public service, educational, or military professions, as well as income-driven repayment (IDR) plans.

- Only federal direct loans qualify for forgiveness, not private student loans.

- Borrowers must apply and continue making payments until they meet the program’s requirements.

- Loan forgiveness can provide significant financial relief for those struggling with student debt.

Definition of Loan Forgiveness

Loan forgiveness means wiping out a debt, freeing the borrower from repaying it. For student loans, this usually applies to those from the U.S. government or its partners, not private lenders.

Key Takeaways on Loan Forgiveness

Forgiving student loans can wipe out part or all of a borrower’s federal debt. But, only federal direct loans can join forgiveness programs. Borrowers can get forgiveness by working in public service and paying on time for a set period.

Loans can also be forgiven if the school misled the student. This is beyond the borrower’s control.

- Student loan forgiveness eliminates part or all of a borrower’s federal student loan debt.

- Only federal direct loans qualify for forgiveness programs.

- Borrowers can earn forgiveness by working in public service and making regular payments.

- Loans may be discharged if the educational institution defrauded the student.

In Los Angeles, more than one in six adults (16.9%) have student loan debt, totaling $54.5 million with an average balance of $42,060. The Public Service Loan Forgiveness (PSLF) program has canceled $69.2 billion in loans for 946,000 borrowers by July 2024. This helps government and nonprofit workers have their debt wiped out after 10 years of qualifying payments.

“The definition of student loan forgiveness and its key takeaways are crucial for borrowers to understand their options and eligibility for relief.”

Types of Student Loan Forgiveness

There are different ways to get student loan forgiveness. Two main types are Public Service Loan Forgiveness (PSLF) and forgiveness through income-driven repayment plans.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program helps those working in the public sector. It forgives the remaining balance of federal student loans after 120 qualifying payments. This is for those in qualifying public service jobs.

- Eligible public service jobs include work for the government, non-profit organizations, and certain types of military service.

- Borrowers must have Direct Loans and make payments under an income-driven repayment plan to qualify for PSLF.

- According to the Federal Reserve, in 2019, adults with college debt typically owed between $20,000 and $24,999.

Repayment Plans With Loan Forgiveness

Income-driven repayment (IDR) plans, like Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE), offer forgiveness after 20-25 years. Payments are based on income and family size. Any remaining balance is forgiven after the repayment period.

| Repayment Plan | Forgiveness Period | Eligibility |

|---|---|---|

| Income-Based Repayment (IBR) | 25 years | Any federal student loan, except PLUS loans for parents |

| Income-Contingent Repayment (ICR) | 25 years | Any federal student loan, including PLUS loans for parents |

| Pay As You Earn (PAYE) | 20 years | Any federal student loan, except PLUS loans for parents |

Loan Forgiveness

Loan forgiveness programs can greatly help borrowers by wiping out part or all of their federal student loan debt. But, only certain borrowers qualify. They must meet specific requirements to get this help.

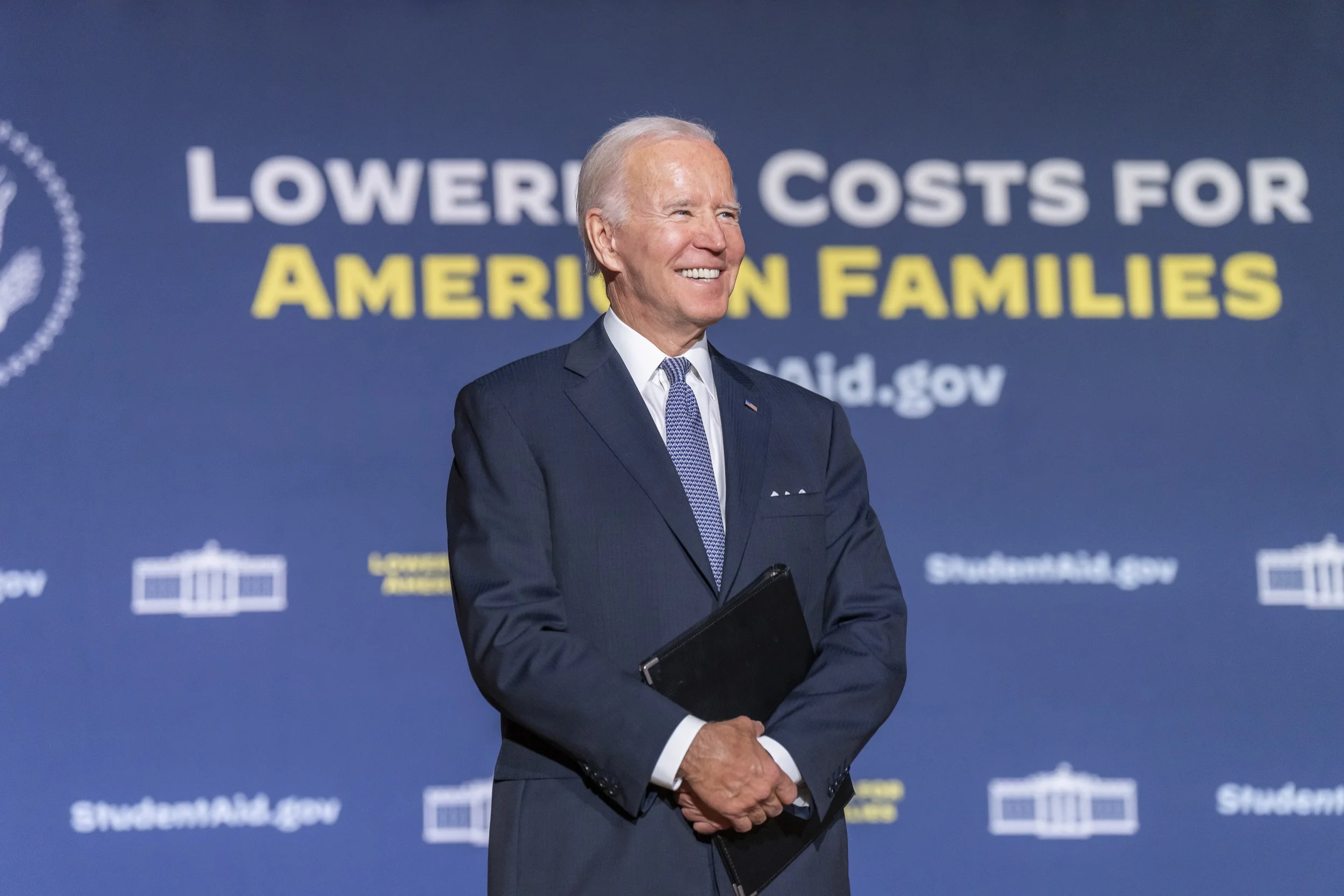

The Biden-Harris Administration has given $146 billion in debt relief to 4 million Americans. They did this through over 20 executive actions. Also, nearly 8 million borrowers are in the SAVE plan. This includes 4.5 million paying $0 a month and 1 million paying less than $100.

The Administration plans to wipe out interest for 23 million borrowers. They also aim to cancel all debt for over 4 million. Plus, more than 10 million will get at least $5,000 in debt relief. This is a big step towards solving the student debt problem, which is a big political issue.

The Public Service Loan Forgiveness (PSLF) program forgives loans after 120 qualifying payments (10 years) for public service jobs. Borrowers need to apply for consolidation and the PSLF program by October 31, 2022, to get these benefits.

Income-Driven Repayment (IDR) plans limit monthly payments based on income and family size. Forgiveness can happen after 20 or 25 years of repayment. The Department of Education has made changes. Now, borrowers in repayment, deferment, or forbearance can count towards forgiveness under IDR plans.

Even with these efforts, student debt is still a big worry. This is especially true for those who went to schools that lost federal aid eligibility. The Biden Administration wants to help these borrowers too.

Eligibility and Application Process

To get student loan forgiveness, you need federal direct loans. You must also meet the program’s specific requirements. The application steps differ based on the forgiveness program you’re applying for.

Applying for PSLF

For the Public Service Loan Forgiveness (PSLF) program, you must work full-time in a qualifying job. You also need to make 120 qualifying payments. To apply, consolidate your loans, fill out the PSLF certification form each year, and keep making payments until you’re forgiven.

Applying for IDR Plan Forgiveness

If you’re in an Income-Driven Repayment (IDR) plan, you might get forgiveness after 20-25 years of payments. To start, enroll in an eligible IDR plan. Then, recertify your income every year and make the needed payments. President Biden’s IDR Account Adjustment program can also help by counting some payments towards your forgiveness term.

| Forgiveness Program | Eligibility Requirements | Application Process |

|---|---|---|

| Public Service Loan Forgiveness (PSLF) | – Federal direct loans – Full-time employment in a qualifying public service job – 120 qualifying monthly payments |

– Consolidate loans – Submit PSLF certification form annually – Continue making payments until forgiveness |

| Income-Driven Repayment (IDR) Plan Forgiveness | – Federal direct loans – Enrollment in an eligible IDR plan – 20-25 years of qualifying payments |

– Enroll in IDR plan – Recertify income annually – Make required number of payments |

The Biden administration has introduced new plans like the IDR Account Adjustment and the SAVE plan. These aim to make getting student loan forgiveness easier and more beneficial for those who qualify.

Biden Administration’s SAVE Plan

In 2023, the Biden administration introduced the Saving on a Valuable Education (SAVE) plan. It’s a new way for student loan borrowers to repay their loans. The plan aims to forgive loans of $12,000 or less after 10 years of payments.

But, the SAVE plan has faced legal challenges. In June 2024, federal courts blocked some key parts of the program. This means the full SAVE plan is on hold until a final decision is made.

Despite these legal issues, over 8 million borrowers have signed up for the SAVE plan. It promises to lower monthly payments, even to $0 for some. However, the court’s ruling has paused payments for these borrowers. The Education Department says they won’t have to worry about interest during this time.

The fight over the SAVE plan’s future is still going on. A Democratic win in the next election might save the plan. But, a Republican victory could end it.

The Biden administration is still working to help student loan borrowers. Education Secretary Miguel Cardona says they’re trying to overcome the court decisions. They want to make sure the SAVE plan can help everyone.

The SAVE plan’s uncertain future shows the big challenges student loan borrowers face. It also shows the need for better solutions to help with educational debt in the U.S.

Also Read: Is Refinance Worth It? Pros And Cons Of Auto Loan Refinancing

Conclusion

Student loan forgiveness is a key way for borrowers to ease their debt burden. In the U.S., over 43 million people owe $1.6 trillion in student loans. This shows the urgent need for effective loan forgiveness plans.

Programs like Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) help some borrowers. But, they have strict rules. The Biden administration’s SAVE plan aimed to help more, but it’s facing legal hurdles.

The student debt problem is getting worse, with college costs up 56% in 20 years. The government is taking steps to help, like the $40 billion from the American Rescue Plan. If proposed debt cancellation goes through, it could greatly benefit many people.

FAQs

Q: What is the loan forgiveness program?

A: The loan forgiveness program is a government initiative that allows borrowers to have part or all of their student debt canceled after meeting specific criteria, such as consistent payments over a certain period or working in public service jobs.

Q: Who is eligible for the student loan forgiveness plan?

A: Eligibility for the student loan forgiveness plan varies depending on the type of program. Generally, borrowers who meet the requirements of a specific forgiveness program, like the Public Service Loan Forgiveness Program, can qualify for debt relief.

Q: How does the Biden administration’s student debt cancellation work?

A: The Biden administration’s student debt cancellation aims to provide relief to borrowers through various forgiveness options, including an income-driven repayment plan that adjusts monthly payments based on the borrower’s income, leading to potential loan cancellation after a set period.

Q: What are the different forgiveness options for student loans?

A: There are several forgiveness options for student loans, including the Public Service Loan Forgiveness Program, Teacher Loan Forgiveness, and income-driven repayment plans that can lead to cancellation after 20 or 25 years of qualifying payments.

Q: Can I receive loan forgiveness if I have federal Perkins loans?

A: Yes, borrowers with federal Perkins loans may qualify for loan forgiveness through various programs, including those for public service or teaching, as long as they meet the specific terms of the forgiveness plan.

Q: What is the process for applying for student loan relief?

A: To apply for student loan relief, borrowers must typically submit an application to their loan servicer, detailing their eligibility for a specific forgiveness program and providing any required documentation.

Q: How does the income-driven repayment plan affect my loan payments?

A: The income-driven repayment plan calculates monthly loan payments based on a borrower’s income and family size, which can lead to lower payments and eventual loan forgiveness after meeting the repayment terms.

Q: What should I do if my loan servicer is not providing accurate information about forgiveness programs?

A: If your loan servicer is not providing accurate information, you can contact the Federal Student Aid Information Center or the Department of Education for assistance, and you may consider switching to a different loan servicer if necessary.

Q: Are there any new student loan forgiveness options available under the Biden administration?

A: Yes, the Biden administration has introduced new student loan forgiveness options, expanding eligibility criteria for existing programs and introducing temporary relief measures in response to the ongoing economic impacts of the COVID-19 pandemic.

Q: How can I stay updated on changes to student debt relief programs?

A: To stay updated on changes to student debt relief programs, borrowers should regularly check the Federal Student Aid website, follow updates from the Department of Education, and subscribe to newsletters or alerts from reputable financial aid organizations.